Green Tax Breaks: Incentives for Sustainable Living in Jamaica

- Shyanne Mcintosh, B.Sc.(Hon), CA, ACCA

- Dec 9, 2024

- 4 min read

Updated: Dec 10, 2024

Jamaica, an island synonymous with sun, sea, and vibrant culture, is embracing a greener future. In response to the escalating climate crisis, the Jamaican government has implemented a series of forward-thinking tax incentives to promote eco-friendly practices among individuals and businesses. These measures, ranging from tax credits for residential solar systems to corporate tax reductions for renewable energy producers, aim to drive sustainable growth while making green living more accessible and appealing. Here’s an exciting look at how these incentives are shaping a more sustainable Jamaica.

Residential Solar Tax Credit: Empowering Homeowners to Harness the Sun

One of the standout incentives is the tax credit for residential solar photovoltaic (PV) systems. This credit is available to employed and self-employed individuals who invest in solar PV systems for their homes. Designed to encourage Jamaicans to embrace renewable energy, this tax credit significantly offsets the upfront cost of installing solar systems, making it a practical and appealing choice for homeowners.

Legislation and Effective Date: The tax credit for residential solar systems is legislated under the Income Tax Act and was introduced in the fiscal year 2023. The effective date for this incentive is April 2023.

Additionally, this initiative is complemented by the National Housing Trust (NHT) loan programs. Homeowners can access the SMART Energy Loan, which provides up to JMD 1.5 million to finance the installation of energy-saving technologies, including solar panels, batteries, solar water heaters, and other renewable energy solutions like windmills, hydropower, and biomass systems. The loan also covers rainwater harvesting systems. The loan comes with a 5% interest rate and a repayment period of up to 10 years, or until the homeowner reaches the age of 70, whichever comes first.

By transitioning to solar energy, individuals can reduce their reliance on fossil fuels and lower their electricity bills while contributing to the country’s renewable energy goals. This initiative not only empowers homeowners to take control of their energy consumption but also aligns with Jamaica’s broader commitment to achieving a greener, more sustainable future. With the added financial relief of the tax credit and NHT loan, residential solar systems are becoming a realistic option for more Jamaicans.

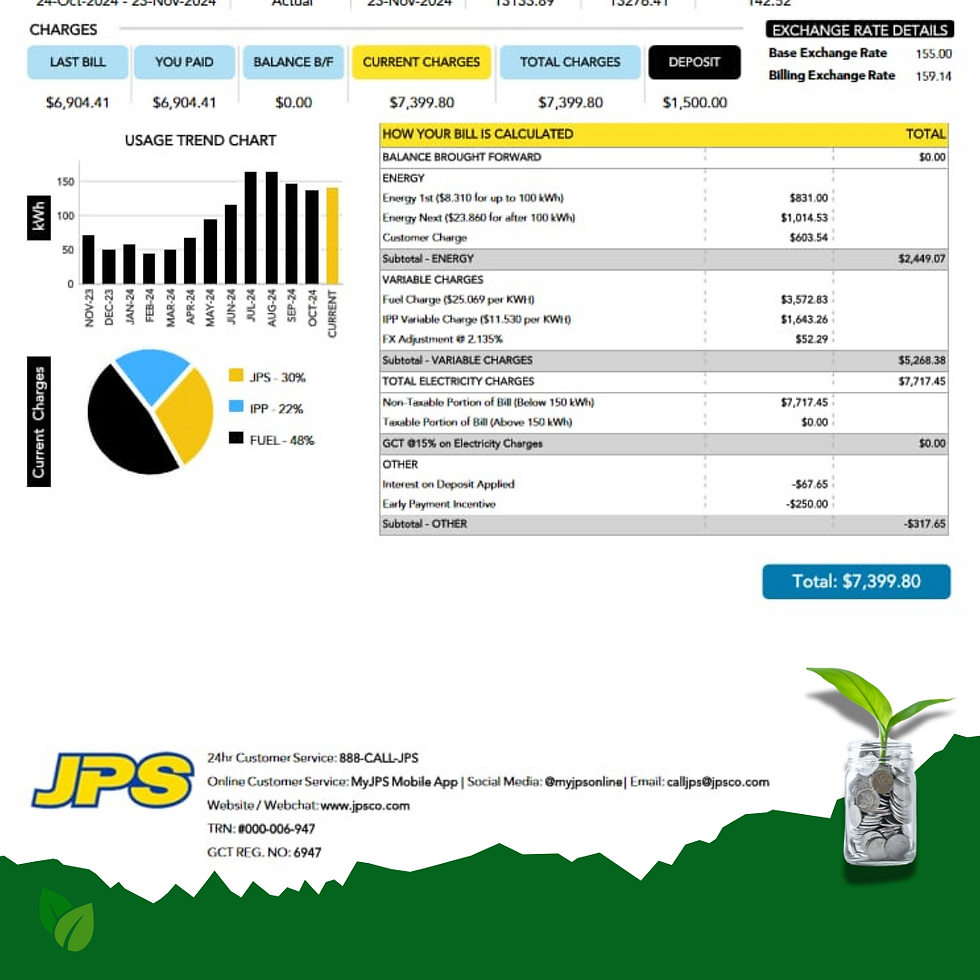

Reduced GCT for Electricity: Lower Bills, Cleaner Energy

Adding to its arsenal of green policies, the Jamaican government has proposed a reduction in the General Consumption Tax (GCT) rate on electricity from 15% to 7%. This initiative is not just about lowering energy costs; it’s about empowering individuals and businesses to better access sustainable energy solutions. By reducing the financial burden of electricity bills, households and businesses are left with more disposable income, which can be redirected towards investments in eco-friendly energy alternatives such as solar and wind power.

However, there are concerns that this reduction could be incongruent with the government’s long-term green energy goals. Lowering electricity costs by approximately 7.5% may inadvertently make traditional electricity more attractive compared to renewable energy sources like solar. The savings realized from the reduced GCT would only be effective as long as consumers continue to use electricity, potentially disincentivizing a switch to greener alternatives. This highlights the need for careful consideration of how these incentives interact to ensure the green energy transition is not hindered.

Corporate Income Tax Relief for Renewable Energy Producers

For businesses in the renewable energy sector, Jamaica has rolled out substantial tax incentives. Independent power producers (IPPs) who generate electricity for sale to the national grid from renewable sources, such as wind and solar, now benefit from a reduction in their corporate income tax (CIT) rate.

Previously, IPPs were taxed at a rate of 33⅓% as "regulated companies." However, under recent amendments to the Income Tax Act, IPPs that produce at least 75% of their energy from renewable sources and are regulated by the Office of Utilities Regulation will now enjoy the standard CIT rate of 25%, effective from the year of assessment 2023.

Recommendation for Further Improvement: There is room for improvement in the thresholds for this reduced tax rate. The government could consider lowering the 75% threshold for the reduced rate to 25% and then gradually increasing it by an additional 25% each year. This approach would reduce entry barriers, allowing businesses to more easily transition to renewable energy while incentivizing further investment in the sector.

It’s important to note that IPPs benefiting from this reduced tax rate will not be eligible for employment tax credits in computing their net income tax liability. However, the significant reduction in CIT rate provides ample motivation for producers to prioritize renewable energy investments.

Urban Renewal Tax Incentives: Revitalizing Communities Sustainably

Jamaica’s Urban Renewal (Tax Relief) Act adds another dimension to its green initiatives. This program provides a suite of tax incentives to individuals and businesses undertaking development projects in designated special development areas, with the goal of restoring and improving these communities.

Investors approved under this Act can benefit from:

Income tax relief on rental income and interest earned from Urban Renewal Bonds.

Exemption from stamp duty and transfer tax on property transfers within designated areas.

These incentives are designed to foster both economic growth and environmental sustainability through urban renewal projects, further contributing to Jamaica’s overall green strategy.

Pioneering a Sustainable Jamaica

Jamaica’s green tax breaks are more than just fiscal measures—they are a bold declaration of the country’s commitment to sustainability. From empowering individuals with residential solar tax credits to incentivizing businesses to embrace renewable energy, these initiatives are creating a blueprint for a greener, more resilient economy.

As Jamaica continues to lead by example, these tax incentives are not only reducing the island’s carbon footprint but also driving innovation, investment, and economic growth. Whether you’re a homeowner exploring solar power, a business considering renewable energy production, or an investor looking to rejuvenate urban areas, Jamaica’s green policies offer an exciting opportunity to be part of the solution.

The time to act is now. With these incentives in place, Jamaica is well on its way to a brighter, cleaner, and more sustainable future. Will you join the movement? Signature Creed would be happy to be your trusted professional advisor along the way.

Comments